🏦 Payments Administration Guide

Updated

by Daniel Westendorf

HOALife Payments makes it easy for homeowners to pay dues and other charges online. Payments can be made using credit or debit cards (Visa, Mastercard, Discover, Apple Pay, Google Pay, and more) or directly from a bank account via ACH. All payment information is securely processed and managed by Stripe, a trusted industry leader in online payments. Funds are automatically deposited into your Association’s connected bank account on a regular schedule.

Security

We take payment security seriously, which is why we’ve partnered with Stripe, a leading and trusted global payments provider. All payment transactions are handled directly by Stripe, which is certified to the highest industry standards, including PCI Level 1 compliance. This means your property owners' payment information is never stored on our servers—Stripe securely processes and encrypts all sensitive data, so they can pay with confidence.

Setup

Stripe uses this information to prevent fraud, money laundering, and unauthorized activity. All submitted data is securely encrypted and handled by Stripe—not HOALife. Most users complete this verification in just a few minutes.

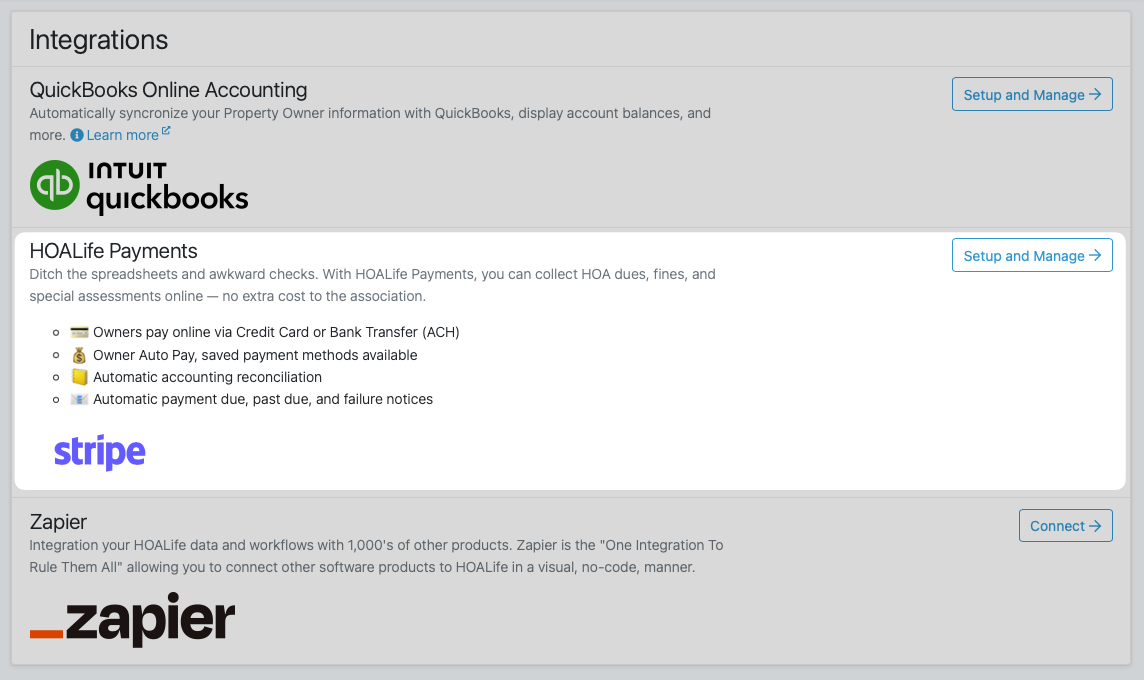

- From the Dashboard, click the Association dropdown and select Integrations. Select Setup and Manage for the HOALife Payments integration. If you don't have the HOALife Payment integration available, contact support@hoalife.com for help.

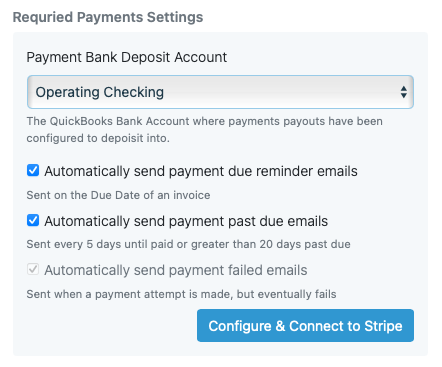

- Select the bank account where you'd like payment payouts to be deposited. Then click Configure & Connect to Stripe to begin the setup process.

You’ll be securely redirected to Stripe to complete identity verification (KYC) and configure your Stripe account.

- Once you complete the Stripe KYC process, you're done! Any outstanding invoices will automatically become payable by homeowners through their Owner Portal.

Processing Fees

HOALife charges the homeowner a processing fee for each payment made through HOALife Payments. This fee is automatically calculated and included in the total at checkout. The full amount, including the fee, is clearly displayed to the property owner before they confirm their payment.

By default, HOALife uses Stripe’s Financial Connections to enable fast and secure bank (ACH) payments. This allows homeowners to log in to their bank directly—eliminating the need for micro-deposit verification and speeding up the payment process and reducing failed payments.

An additional $1.50 processing fee is added to the payment total when using this method. However, unlike standard processing fees, Stripe may handle this fee as a separate transaction. As a result, you might notice:

- A payment total that appears $1.50 higher than expected, or

- A separate $1.50 charge shown in your Stripe account

Regardless, HOALife ensures that enough funds are always collected from the payer to fully cover all fees—your association will never receive less than the invoiced amount.

Payment Statuses & Failed Payments

HOALife marks invoices as paid as soon as payment has successfully been initiated by creating a Payment in QuickBooks Online for the invoice. This is done before the payment has completely settled, a process which may take anywhere from seconds to days depending on the payment method used.

In some cases the payment may ultimately fail (bank rejection, NSF, micro-deposit verification failed, etc.). In this case we will void the Payment and mark the invoice as payable again. Property owners will receive automatic payment fail email notifications from HOALife when this happens, prompting them to retry payment. The invoice will revert from a "paid" status in QuickBooks Online to "unpaid".

Reconciliation & Payouts

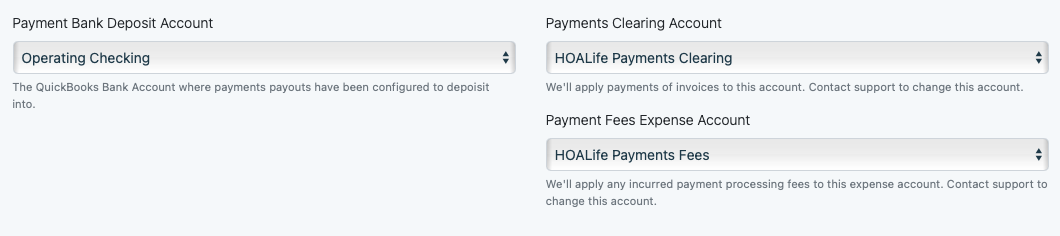

HOALife automatically tracks the flow of funds from Stripe to your bank account, accounting for transfer delays, Stripe's processing time, and fee handling. This is managed using three accounts in QuickBooks Online:

- The Bank Account (configured during Setup)

This is the destination account where payment funds are ultimately deposited. - HOALife Payments Clearing (created automatically)

This clearing account tracks funds while they are held by Stripe—after collection from the homeowner and before they are transferred to your bank account. - HOALife Payments Fees (created automatically)

This account records Stripe processing fees, including those related to Financial Connections (e.g., the $1.50 ACH fee).

Payouts

Stripe payouts are the transfers of available funds from your Stripe balance to your association’s bank account via ACH. If funds are available, Stripe will initiate a payout daily by default.

Stripe automatically transfers available funds to your bank account on a regular schedule—no action is required. Do not initiate instant or manual payouts via the Stripe Dashboard. Doing so bypasses HOALife’s automated reconciliation system. As a result:

- Your accounting records in HOALife and QuickBooks Online may become inaccurate

- You may incur additional fees from Stripe and/or HOALife for manual handling

Always allow payouts to occur automatically to ensure accurate bookkeeping and avoid unnecessary charges.

Reconciliation

When an invoice is paid through HOALife Payments, HOALife automatically:

- Creates a Payment in QuickBooks, marking the invoice as paid.

- Deposits the funds into the HOALife Payments Clearing account, where they remain until transferred by Stripe.

Once Stripe issues a payout, HOALife automatically records the appropriate journal entries to move funds between:

- Clearing Account → Bank Account (the actual deposit)

- Clearing Account → Fees Account (Stripe processing fees)

If a payment later fails (e.g., due to insufficient funds), the payment is voided and the corresponding amount is removed from the Clearing account to keep your books accurate.

Payment Emails

When HOALife Payments are enabled, HOALife automatically sends four types of payment-related emails to property owners:

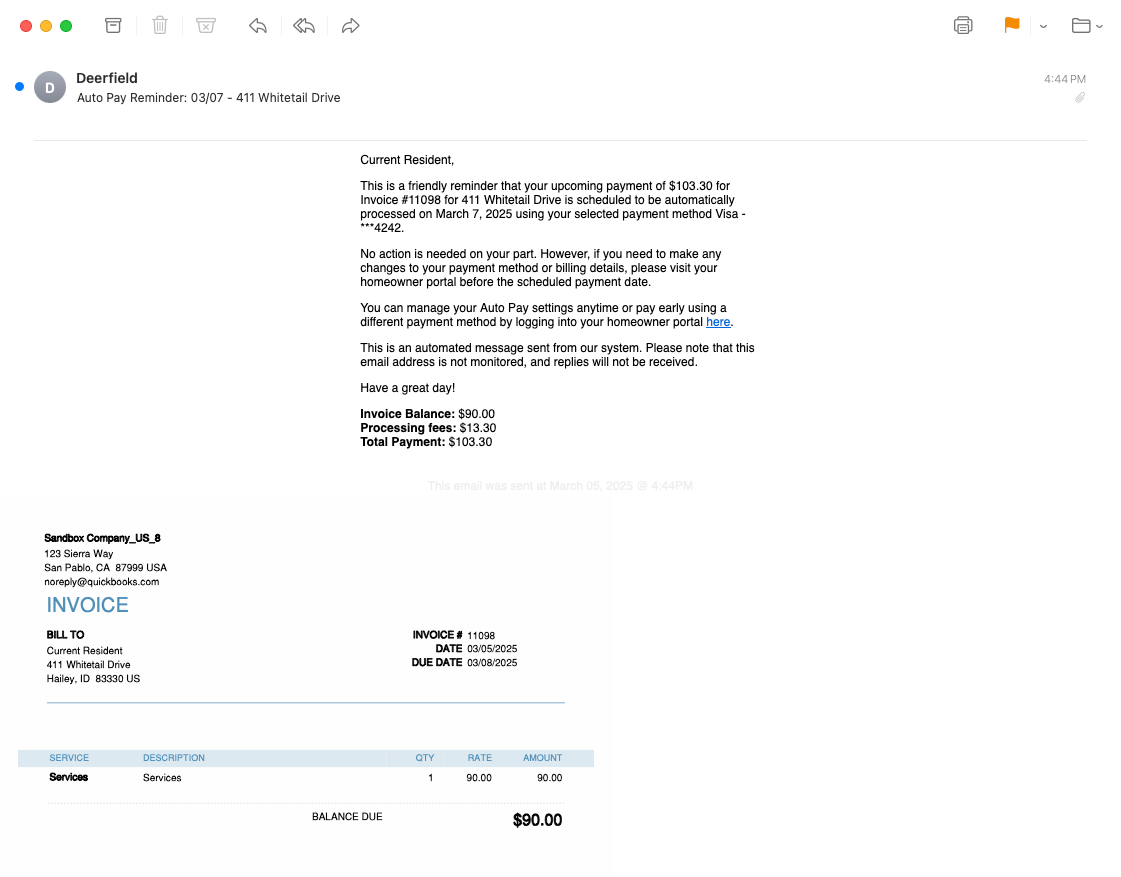

✅ Auto Pay Reminder

Sent only to property owners who have enabled Auto Pay.

- Serves as a reminder before the payment is processed.

- This email cannot be disabled.

- See: Homeowner Payments – Auto Pay for more details.

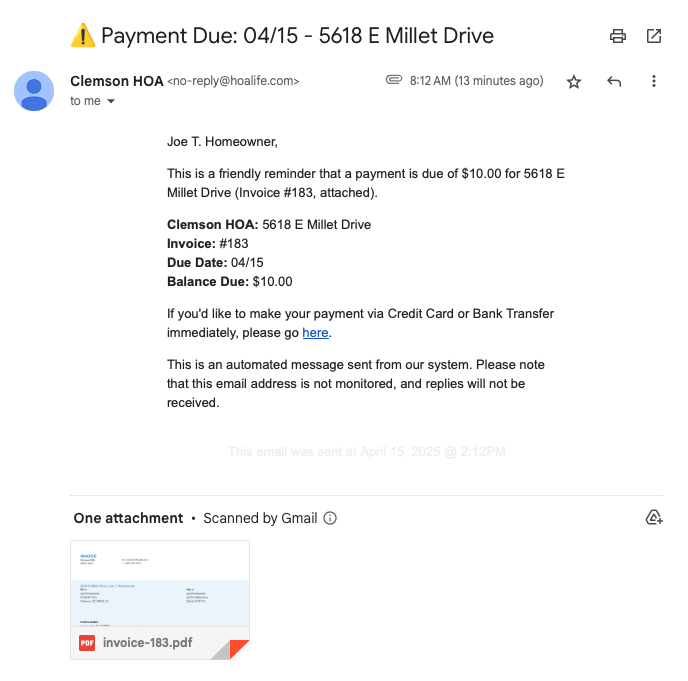

💵 Payment Due Reminder

Sent on the invoice due date if Auto Pay is not enabled.

- Reminds owners that a payment is due.

- This email can be disabled.

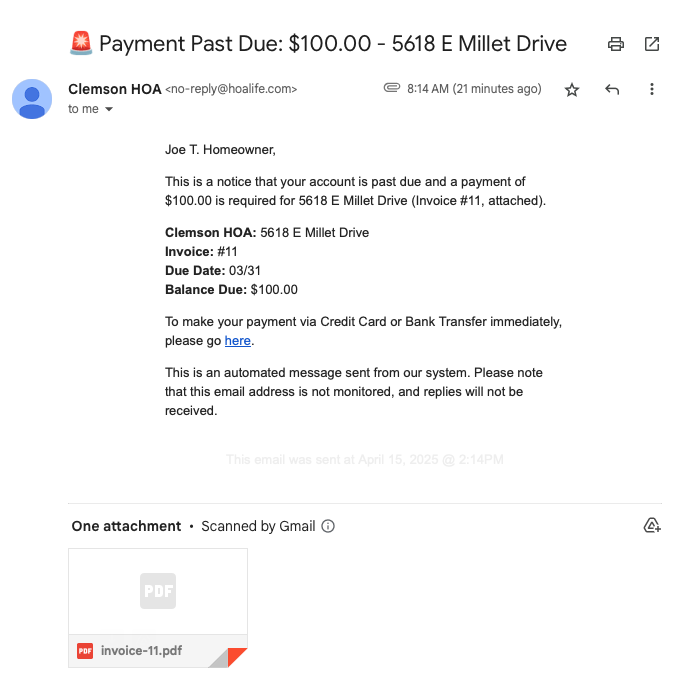

⏰ Payment Past Due

Sent one day after the invoice due date if payment is still outstanding.

- Resent every 5 days until the invoice is paid or more than 20 days have passed.

- Helps associations collect on unpaid invoices.

- This email can be disabled.

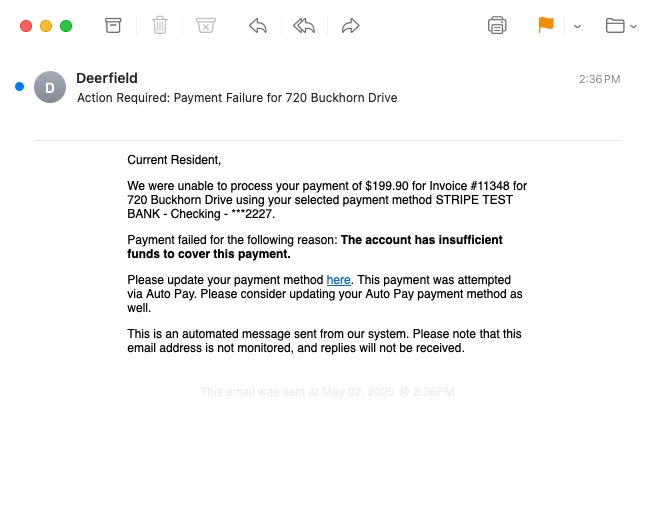

❌ Payment Failed

Sent when a payment attempt is unsuccessful (e.g., card declined or ACH failure).

- This email cannot be disabled.